flow through entity irs

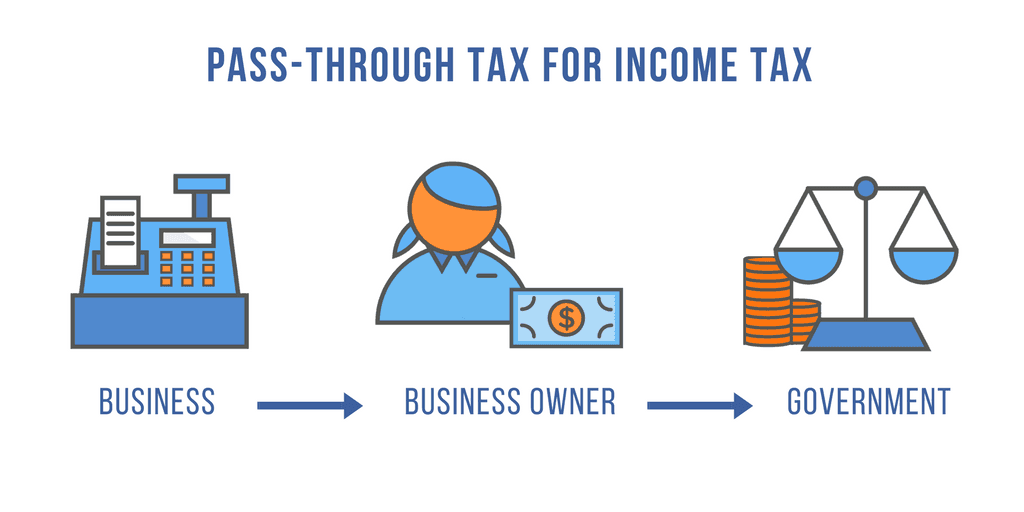

In the end the purpose of flow-through entities is the same as that of the other. Flow-through entities are considered to be pass-through entities.

What Is A Disregarded Entity And How Are They Taxed Ask Gusto

These parties then report the gains and losses on their own tax returns.

. Many businesses are taxed as flow-through entities that unlike C corporations are not subject to the corporate income tax. In tax years beginning in 2021 flow-through entities with items of international tax relevance must complete the new schedules as described in the instructions and the updates posted on January 18 2022. A flow-through is a business entity that may generate or receive taxable income but which pays no income tax in its own right.

The Flow-through Entities Tax section is a compilation of alerts and articles written by members of the ICPAS Flow-through Entities Tax Committee. Flow-through businesses include sole proprietorships partnerships and S. Regulations continue to change the thresholds and treatment of both revenue and expenses for many organizations.

Flow-Through Entity Tax - Ask A Question. ASC 740 contains minimal explicit guidance on the accounting for deferred taxes associated with investments in partnerships or other flow-through entities eg LLCs. Follow the links below for more information on these topics.

Flow-Through Entity Tax - Ask A Question. As a result only the individuals not the business are taxed on the revenue thereby avoiding double taxation. See FAQ 17 for links.

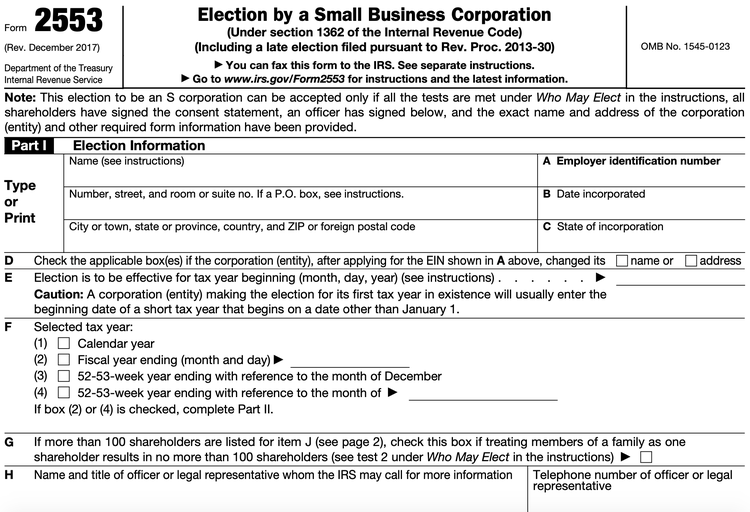

Flow-through entities are used for several reasons including tax advantages. Flow-through or pass-through entities are not subject to corporate income tax though the Internal Revenue Service does require that they file a K-1 statement annually. A system of journal entries in the business general ledger is an effective way to record and reconcile partnership and LLC tax attributes and provide more valuable information to partners and LLC members.

Hence the income of the entity is the same at the income of the owners or investors. The benefits and tax obligations of operating flow-through entities and pass-through businesses are more complex than ever. The resulting avoidance of.

However the late filing of 2021 FTE returns will be accepted. This means that the flow-through entity is responsible for the taxes and does not itself pay them. The business income tax base refers to the flow-through entitys federal taxable income and any payments and items of income and expense that are attributable to the business activity of the flow-through entity and separately reported to its members less specific statutory adjustments andor special additional adjustments for a tiered structure.

A flow-through entity is a legal entity where income flows through to investors or owners. That is the income of the entity is treated as the income of the investors or owners. In this legal entity income flows through to the owners of the entity or investors as the case may be.

We believe that deferred taxes related to an investment in a foreign or domestic partnership and other flow-through entities that are taxed as partnerships such as multi-member LLCs should be based on the. The most typical function of a flow-through entity is to ensure that its owners and investors are not subject to double taxation which is the case for C-corporations. Strategic tax services for pass-through businesses and partnerships.

Log on to Michigan Treasury Online MTO to update business details authorized representative information and to file or pay tax returns. A flow-through entity is a business in which income is passed straight to its shareholders owners or investors. Placing Tax Attributes in a Partnership or LLCs General Ledger.

Flow-through entities are also known as pass-through entities or fiscally-transparent entities. 2021 Flow-Through Entity FTE annual return payments must be made timely to avoid penalty and interest. As well as links to websites and other resources of interest to the flow-through entities tax community.

You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following. Understanding What a Flow-Through Entity Is. International tax relevance is determined under each part of the new schedules.

If a reduced rate of withholding under an income tax treaty is claimed the claimant must be able to treat as a flow-through entity any entity between you and the claimant. Common types of FTEs are general partnerships limited partnerships and limited liability partnerships. A flow-through entity is a business entity is which income of the entity passes on to the investors or owners of the entity.

Instead their owners include their allocated shares of profits in taxable income under the individual income tax which is taxed as ordinary income up to the maximum 396 percent rate. A trust maintained primarily for the benefit of employees of a corporation or 2 or more corporations that do not deal at arms length with each other where one of the main purposes of the trust is to hold interests in shares of the capital. Partner of a partnership must report the partners distributive share of the partnerships gains income deduction s losses or.

Its gains and losses are allocated or flow through to those with ownership interests. This requires many business owners and members of flow. Flow-through entities FTEs affect an individuals Foreign Tax Credit FTC by impacting foreign source gross income foreign s ource taxable income worldwide gross income worldwide taxable income and foreign taxes available for credit.

The determination of whether an entity is fiscally transparent is made on an item of income basis that is the determination is made separately for interest dividends royalties etc.

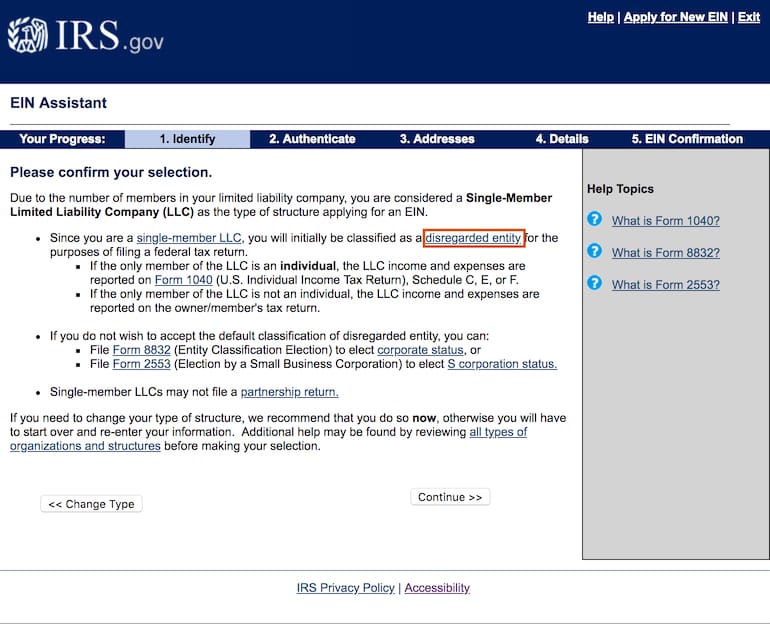

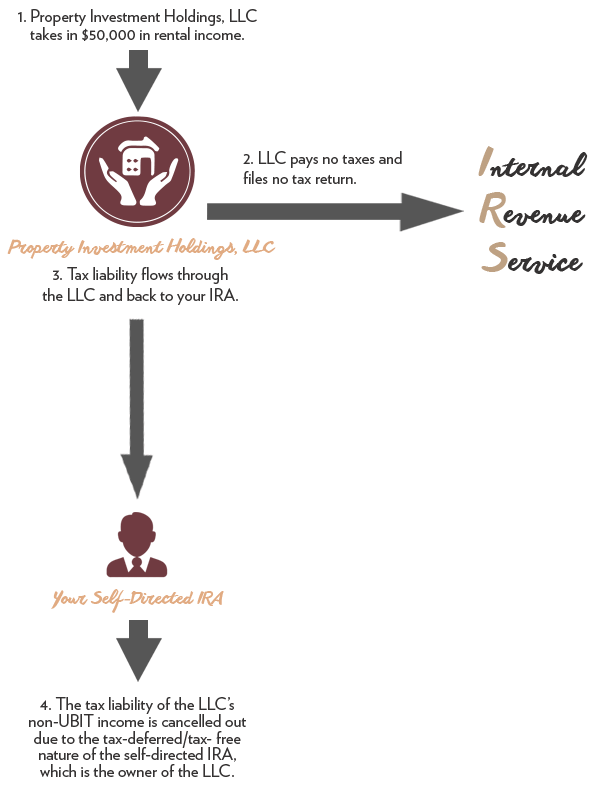

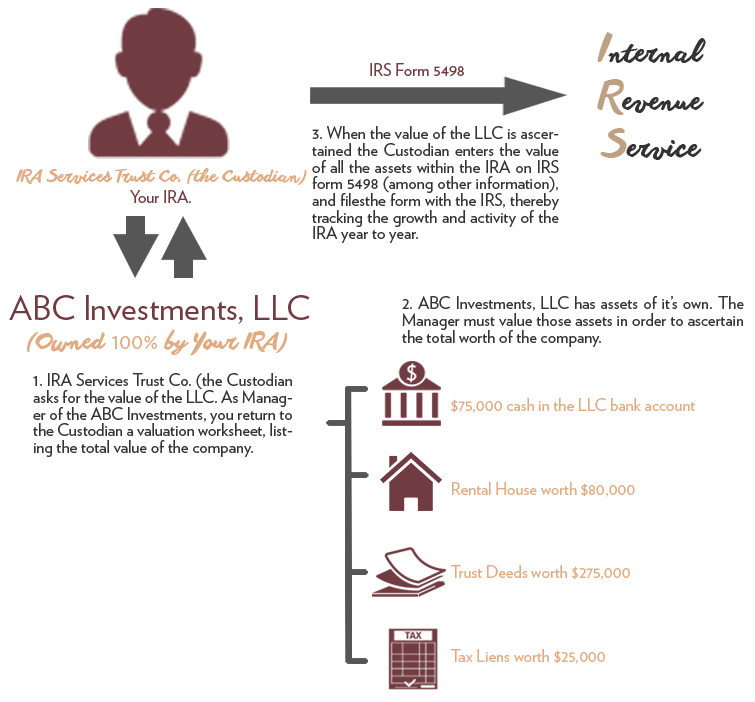

Irs Filing Requirements For Check Book Ira

How To Fill Out Irs Form 8858 Foreign Disregarded Entity Youtube

How Should An Llc Fill Out A W 9 Form Correctly Ssn Vs Ein W9manager

4 31 2 Tefra Examinations Field Office Procedures Internal Revenue Service

Do Llcs Get 1099 S During Tax Time Fundsnet

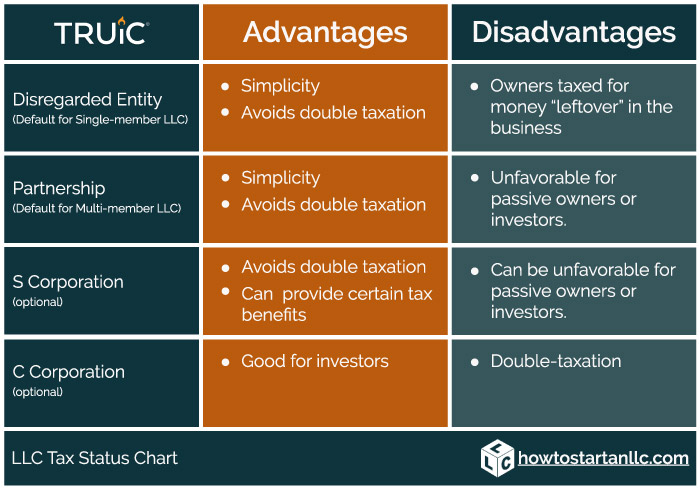

How To Choose Your Llc Tax Status Truic

Pass Through Taxation What Small Business Owners Need To Know

3 13 2 Bmf Account Numbers Internal Revenue Service

Flow Through Entity Overview Types Advantages

A Beginner S Guide To Pass Through Entities

8 19 1 Procedures And Authorities Internal Revenue Service

Irs Filing Requirements For Check Book Ira

How Should An Llc Fill Out A W 9 Form Correctly Ssn Vs Ein W9manager